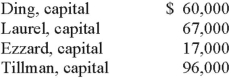

A local partnership was considering the possibility of liquidation since one of the partners (Ding) was personally insolvent. Capital balances at that time were as follows. Profits and losses were divided on a 4:2:2:2 basis, respectively.  Creditors of partner Ding filed a $25,000 claim against the partnership's assets. At that time, the partnership held noncash assets reported at $360,000 and liabilities of $120,000. There was no cash on hand at the time.

Creditors of partner Ding filed a $25,000 claim against the partnership's assets. At that time, the partnership held noncash assets reported at $360,000 and liabilities of $120,000. There was no cash on hand at the time.

If the assets could be sold for $228,000, what is the minimum amount that Laurel's creditors would have received?

Definitions:

Autocracy

A form of government in which a single individual holds unlimited power, making decisions without substantial consultation or democratic participation.

Social Movement

Organized, collective efforts by people to bring about or resist social change, often aimed at addressing social issues or injustices.

Wartime Deaths

Fatalities that occur during armed conflict, including both military personnel and civilians.

Charismatic Figures

Individuals who possess a unique set of personality traits that inspire devotion, loyalty, and enthusiasm among followers.

Q3: A not-for-profit hospital is described by all

Q17: Kennedy Company acquired all of the outstanding

Q21: What is the role of the trustee

Q25: As of January 1, 2013, the partnership

Q32: Tests using sound waves may be performed

Q32: What guidelines must be followed to classify

Q50: Assuming all of the following expenses have

Q62: What are accredited investors?

Q65: What is included in Part I of

Q79: Lucky Co. had cash of $65,000, inventory