Hardin, Sutton, and Williams have operated a local business as a partnership for several years. All profits and losses have been allocated in a 3:2:1 ratio, respectively. Recently, Williams has undergone personal financial problems, and is insolvent. To satisfy Williams' creditors, the partnership has decided to liquidate.

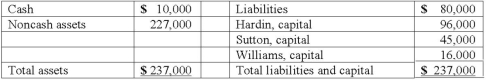

The following balance sheet has been produced:

During the liquidation process, the following transactions take place:

- Noncash assets are sold for $116,000.

- Liquidation expenses of $12,000 are paid. No further expenses are expected.

- Safe capital distributions are made to the partners.

- Payment is made of all business liabilities.

- Any deficit capital balances are deemed to be uncollectible.

Develop a predistribution plan for this partnership, assuming $12,000 of liquidation expenses are expected to be paid.

Definitions:

Persuasion

The process of influencing someone's beliefs, attitudes, intentions, motivations, or behaviors through communication.

Counterarguments

Reasoning or arguments presented in opposition to an initial argument or standpoint.

Child Molesters

Refers to individuals who sexually abuse children under the age of consent.

Sexual Thoughts

Cognitive processes or mental reflections focused on sexual desire, activity, or attraction.

Q8: The American Health Benefit Exchanges and Small

Q16: The provisions of a will currently undergoing

Q24: Convergence of accounting standards would not occur

Q32: A foreign subsidiary was acquired on January

Q33: The following part of the economic cycle

Q39: Ginvold Co. began operating a subsidiary in

Q43: What is the primary focus of the

Q48: Which statement is false regarding the government-wide

Q53: Describe the two parts of the SEC

Q69: The Albert, Boynton, and Creamer partnership was