Hardin, Sutton, and Williams have operated a local business as a partnership for several years. All profits and losses have been allocated in a 3:2:1 ratio, respectively. Recently, Williams has undergone personal financial problems, and is insolvent. To satisfy Williams' creditors, the partnership has decided to liquidate.

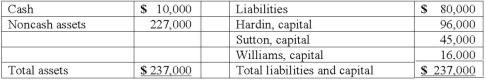

The following balance sheet has been produced:

During the liquidation process, the following transactions take place:

- Noncash assets are sold for $116,000.

- Liquidation expenses of $12,000 are paid. No further expenses are expected.

- Safe capital distributions are made to the partners.

- Payment is made of all business liabilities.

- Any deficit capital balances are deemed to be uncollectible.

Compute safe cash payments after the noncash assets have been sold and the liquidation expenses have been paid.

Definitions:

Offeror

The party in a contract negotiation that proposes the terms of an agreement to another party, known as the offeree.

Uniform Commercial Code

A comprehensive set of laws governing commercial transactions in the United States, aimed at standardizing practices across states.

Assignment of Accounts Receivable

The transfer of the right to collect money owed on outstanding invoices from the original creditor to another party.

Security Interest

A lien given by a debtor to his creditor to secure payment or performance of a debt or obligation.

Q2: An environment where there are few sellers

Q6: A _ is a system where payment

Q7: A partnership began its first year of

Q10: What is the difference between an executor

Q11: The board of commissioners of the city

Q19: Cleary, Wasser, and Nolan formed a partnership

Q32: The balance sheet of Rogers, Dennis &

Q43: When there are not enough assets in

Q55: Deficit capital balances<br>A schedule should be produced

Q69: What is the dissolution of a partnership?