Hardin, Sutton, and Williams have operated a local business as a partnership for several years. All profits and losses have been allocated in a 3:2:1 ratio, respectively. Recently, Williams has undergone personal financial problems, and is insolvent. To satisfy Williams' creditors, the partnership has decided to liquidate.

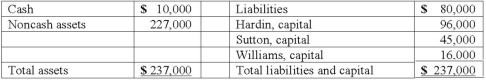

The following balance sheet has been produced:

During the liquidation process, the following transactions take place:

- Noncash assets are sold for $116,000.

- Liquidation expenses of $12,000 are paid. No further expenses are expected.

- Safe capital distributions are made to the partners.

- Payment is made of all business liabilities.

- Any deficit capital balances are deemed to be uncollectible.

Prepare journal entries to record the actual liquidation transactions.

Definitions:

Adam Smith

A Scottish economist and philosopher, best known for his book "The Wealth of Nations," in which he laid the foundations of classical free market economic theory.

Karl Marx

A 19th-century philosopher, economist, and political theorist best known for his theories about capitalism and communism.

Plant And Equipment

Refers to the tangible assets that are used in the operation of a business or industry including machinery, buildings, and vehicles.

Society Control

Mechanisms, processes, and institutions through which societies regulate behavior and maintain order, stability, and cohesion.

Q5: Why is the SEC's Rule 14c-3 important

Q19: How does a voluntary health and welfare

Q26: A deductible is the:<br>A) portion of services

Q27: Quadros Inc., a Portuguese firm was acquired

Q29: Which one of the following is not

Q48: Xygote, Yen, and Zen were partners who

Q61: Which statement is not correct?<br>A) Governmental funds

Q70: The executor of Danny Mack's estate has

Q71: A city enacted a special tax levy

Q72: A highly inflationary economy is defined as<br>A)