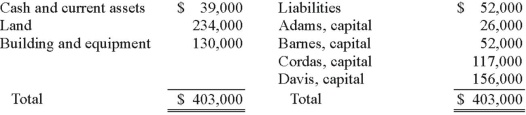

The ABCD Partnership has the following balance sheet at January 1, 2012, prior to the admission of new partner, Eden.

Eden acquired a 20% interest in the partnership by contributing a total of $71,500 directly to the other four partners. No goodwill is to be recorded. Profits and losses have previously been split according to the following percentages: Adams, 15%, Barnes, 35%, Cordas, 30%, and Davis, 20%. After Eden made his investment, what were the individual capital balances?

Definitions:

Mutually Exclusive Projects

Projects where the acceptance of one will automatically exclude the option of accepting the other.

IRR Rule

A guideline for evaluating potential investments wherein an investment is considered acceptable if its internal rate of return exceeds a predefined threshold.

NPV Rule

A principle stating that an investment should be made if its Net Present Value (NPV) is positive, indicating that the project's returns exceed its costs.

Marginal Income Tax Rate

The percentage of tax applied to your income for every dollar that falls within a certain tax bracket.

Q3: The Town of Wakefield opened a solid

Q12: The Patient Protection and Affordable Care Act

Q18: Mental illness:<br>A) is usually a chronic lifetime

Q24: In accruing patient charges for the current

Q31: The Town of Portsmouth has at the

Q45: Under modified accrual accounting, revenues should be

Q48: In countries where there is less pressure

Q51: Perez Company, a Mexican subsidiary of a

Q71: What happens when a U.S. company purchases

Q85: A net asset balance sheet exposure exists