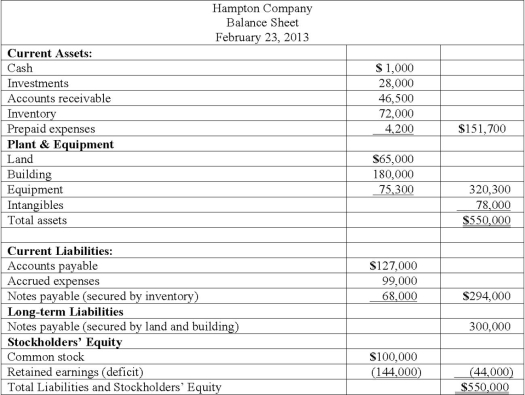

Hampton Company is trying to decide whether to seek liquidation or reorganization. Hampton has provided the following balance sheet:

Additional information is as follows:

• The investments are currently worth $13,000.

• It is estimated that $32,000 of the accounts receivable are collectible.

• The inventory can be sold for $74,000.

• The prepaid expenses and the intangible assets have no net realizable value.

• The land and building are currently valued at $250,000.

• The equipment can be sold for $60,000.

• Administrative expenses (not yet recorded) are estimated to be $12,500.

• Accrued expenses include $17,000 of salaries payable ($11,000 to one employee and $3,000 each to two other employees).

• Accrued expenses include $7,000 of unpaid payroll taxes.

Compute the amount of total assets available to pay liabilities with priority and unsecured creditors.

Definitions:

Initial Investment

Initial investment refers to the amount of money invested in a project, asset, or business venture at the start.

Crossover Rate

The point at which two projects have the same net present value (NPV), used in capital budgeting to determine the rate of return at which an investor would be indifferent between the two projects.

Mutually Exclusive

Situations or decisions that cannot occur or be made simultaneously because the occurrence of one excludes the possibility of the other.

Expected Results

Predicted outcomes of a particular action or business strategy, usually based on data analysis or historical performance.

Q2: How should liabilities (except for deferred income

Q8: An inter vivos trust was created by

Q8: Tower Company owns 85% of Hill Company.

Q13: The partnership of Rayne, Marin, and Fulton

Q25: A partnership began its first year of

Q30: The IASB and FASB are working on

Q30: Which entry would be the correct entry

Q58: The following information pertains to inventory held

Q71: Cleary, Wasser, and Nolan formed a partnership

Q84: On January 1, 2013, a subsidiary bought