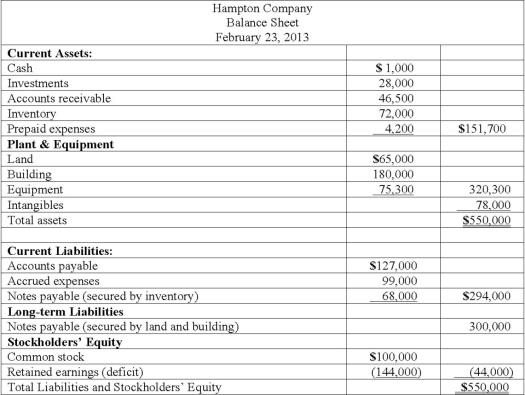

Hampton Company is trying to decide whether to seek liquidation or reorganization. Hampton has provided the following balance sheet:

Additional information is as follows:

• The investments are currently worth $13,000.

• It is estimated that $32,000 of the accounts receivable are collectible.

• The inventory can be sold for $74,000.

• The prepaid expenses and the intangible assets have no net realizable value.

• The land and building are currently valued at $250,000.

• The equipment can be sold for $60,000.

• Administrative expenses (not yet recorded) are estimated to be $12,500.

• Accrued expenses include $17,000 of salaries payable ($11,000 to one employee and $3,000 each to two other employees).

• Accrued expenses include $7,000 of unpaid payroll taxes.

Compute the amount of assets available for unsecured creditors after payment of liabilities with priority.

Definitions:

Book Value

The value of an asset according to its balance sheet account balance, taking into account the cost of the asset minus any depreciation.

Extraordinary Gains

Gains that arise from events that are both unusual and infrequent, not expected to recur regularly in the normal course of business.

Value-Irrelevant Earnings

Earnings that have no impact on the market price of a company's stock.

High Quality

In the context of products or services, high quality refers to the degree to which they meet or exceed customers' expectations and standards.

Q5: Harrison Company, Inc. began operations on January

Q10: Retro Corp. was engaged solely in manufacturing

Q24: According to U.S. GAAP, what revenues and

Q24: Which one of the following Federal laws

Q31: The Keaton, Lewis, and Meador partnership had

Q48: In countries where there is less pressure

Q65: River Co. owned 80% of Boat Inc.

Q85: A net asset balance sheet exposure exists

Q92: Under the temporal method, how would cost

Q107: Which of the following statements is true