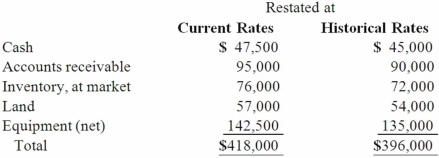

Certain balance sheet accounts of a foreign subsidiary of Parker Company at December 31, 2013, have been restated into U.S. dollars as follows:  If the current rate used to restate these amounts is $.95, what was the average historical rate used to arrive at the total amount for historical rates?

If the current rate used to restate these amounts is $.95, what was the average historical rate used to arrive at the total amount for historical rates?

Definitions:

Goodwill Method

An accounting method used to evaluate the excess of purchase price over the fair value of net identifiable assets acquired in a business combination.

Journal Entries

Recorded transactions in the accounting records of a business that are used to transfer amounts from one account to another, ensuring the ledger remains in balance.

Fair Value

Fair value is an estimate of the market value of an asset, based on its current price in a fair and open market transaction.

Bonus Method

A method in accounting for partnerships where a new partner's investment is recorded at an amount that is different from the stated value of the partnership's net assets, affecting the capital accounts of the existing partners.

Q6: GASB Codification Section N50.104 divides all eligibility

Q12: Norr and Caylor established a partnership on

Q16: Which of the following is not a

Q21: Delta Corporation owns 90 percent of Sigma

Q26: Which of the following are not authoritative

Q31: The Keaton, Lewis, and Meador partnership had

Q38: Parent Corporation acquired some of its subsidiary's

Q65: Williams Inc., a U.S. company, has a

Q102: Franklin Corporation owns 90 percent of the

Q110: B Co. owned 70% of the voting