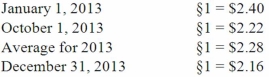

Ginvold Co. began operating a subsidiary in a foreign country on January 1, 2013 by acquiring all of the common stock for §50,000 Stickles, the local currency. This subsidiary immediately borrowed §120,000 on a five-year note with ten percent interest payable annually beginning on January 1, 2014. A building was then purchased for §170,000 on January 1, 2013. This property had a ten-year anticipated life and no salvage value and was to be depreciated using the straight-line method. The building was immediately rented for three years to a group of local doctors for §6,000 per month. By year-end, payments totaling §60,000 had been received. On October 1, §5,000 were paid for a repair made on that date and it was the only transaction of this kind for the year. A cash dividend of §6,000 was transferred back to Ginvold on December 31, 2013. The functional currency for the subsidiary was the Stickle (§). Currency exchange rates were as follows:

Prepare an income statement for this subsidiary in stickles and then translate these amounts into U.S. dollars.

Definitions:

Male Aggression

A behavior pattern seen in males, both human and animal, that is characterized by forceful actions or attitudes intended to dominate or control.

Gender Inequality

The societal mechanism through which individuals face unequal and unfavorable treatment in comparable situations due to their gender.

Separate Issues

Distinct topics or problems that should be considered and addressed independently.

Power And Authority

The ability of individuals or groups to influence others and enforce rules or decisions, often backed by recognized social or legal legitimacy.

Q5: Which statement is false regarding the acceptance

Q7: Ryan Company owns 80% of Chase Company.

Q25: Certain balance sheet accounts of a foreign

Q41: Why are the terms of the Articles

Q42: Jones, Marge, and Tate LLP decided to

Q55: A company has a discount on a

Q78: James, Keller, and Rivers have the following

Q79: Ryan Company owns 80% of Chase Company.

Q93: Dean Hardware, Inc. is comprised of five

Q104: The benefits of filing a consolidated tax