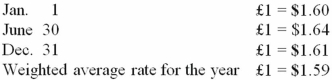

Westmore Ltd., is a British subsidiary of a U.S. company. Westmore's functional currency is the pound sterling (≤) . The following exchange rates were in effect during 2013:  On December 31, 2013, Westmore had accounts receivable of ≤280,000. What amount (rounded) would have been included for this subsidiary in calculating consolidated accounts receivable?

On December 31, 2013, Westmore had accounts receivable of ≤280,000. What amount (rounded) would have been included for this subsidiary in calculating consolidated accounts receivable?

Definitions:

Decay

The gradual reduction or loss of information from memory over time when it is not used or rehearsed.

Retroactive Interference

Forgetting that occurs when recently learned material interferes with the ability to remember similar material stored previously.

Recovered Memories

Memories of traumatic events that were not remembered for a period of time, but have been recalled through therapy or spontaneously.

Skeptical

Having an attitude of doubt or a disposition to incredulity either in general or toward a particular object.

Q2: Who has the responsibility for the evaluation

Q8: Contrast the purpose of remeasurement with the

Q14: The following information pertains to inventory held

Q18: Quadros Inc., a Portuguese firm was acquired

Q30: For each of the following situations, select

Q32: On December 1, 2013, Joseph Company, a

Q43: Cement Company, Inc. began the first quarter

Q54: A company incurs research and development costs

Q94: A subsidiary of Porter Inc., a U.S.

Q111: What related items need to be disclosed