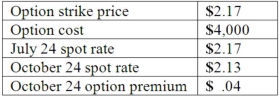

Woolsey Corporation, a U.S. company, expects to sell goods to a British customer at a price of 250,000 pounds, with delivery and payment to be made on October 24. On July 24, Woolsey purchased a three-month put option for 250,000 British pounds and designated this option as a cash flow hedge of a forecasted foreign currency transaction expected to be completed in late October. The following exchange rates apply:  What amount will Woolsey include as an option expense in net income for the period July 24 to October 24?

What amount will Woolsey include as an option expense in net income for the period July 24 to October 24?

Definitions:

Maintenance Rehearsal

A cognitive process involving the repetition of information to keep it within working memory or to encode it for long-term memory.

Retrograde Amnesia

A condition in which people lose the ability to access memories they had before a brain injury.

New Memories

Information or experiences that have been recently encoded into an individual's memory system.

Anterograde Amnesia

A condition in which people lose the ability to form new memories after experiencing a brain injury.

Q5: Kennedy Company acquired all of the outstanding

Q6: What are the three categories of assets

Q9: On January 1, 2013, the partners of

Q18: A company incurs research and development costs

Q28: Which of the following is true concerning

Q29: On January 1, 2013, Parent Corporation acquired

Q48: The appropriate format of the December 31,

Q65: Schilling, Inc. has three operating segments with

Q73: Kennedy Company acquired all of the outstanding

Q103: Peterson Corporation has three operating segments with