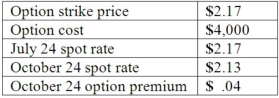

Woolsey Corporation, a U.S. company, expects to sell goods to a British customer at a price of 250,000 pounds, with delivery and payment to be made on October 24. On July 24, Woolsey purchased a three-month put option for 250,000 British pounds and designated this option as a cash flow hedge of a forecasted foreign currency transaction expected to be completed in late October. The following exchange rates apply:  What amount will Woolsey include as Adjustment to Net Income for the period ended October 31?

What amount will Woolsey include as Adjustment to Net Income for the period ended October 31?

Definitions:

Q19: Cleary, Wasser, and Nolan formed a partnership

Q22: Tower Company owns 85% of Hill Company.

Q27: What is the purpose of Chapter 7

Q29: Belsen purchased inventory on December 1, 2012.

Q33: The types of differences that exist between

Q37: The dissolution of a partnership occurs<br>A) only

Q37: What information needs to be included in

Q37: Cement Company, Inc. began the first quarter

Q44: Mount Inc. was a hardware store that

Q73: Cadion Co. owned a controlling interest in