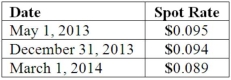

On May 1, 2013, Mosby Company received an order to sell a machine to a customer in Canada at a price of 2,000,000 Mexican pesos. The machine was shipped and payment was received on March 1, 2014. On May 1, 2013, Mosby purchased a put option giving it the right to sell 2,000,000 pesos on March 1, 2014 at a price of $190,000. Mosby properly designates the option as a fair value hedge of the peso firm commitment. The option cost $3,000 and had a fair value of $3,200 on December 31, 2013. The following spot exchange rates apply:  Mosby's incremental borrowing rate is 12 percent, and the present value factor for two months at a 12 percent annual rate is .9803.

Mosby's incremental borrowing rate is 12 percent, and the present value factor for two months at a 12 percent annual rate is .9803.

What was the impact on Mosby's 2014 net income as a result of this fair value hedge of a firm commitment?

Definitions:

Cost Of Capital

The rate of return a company must earn on its project investments to maintain its market value and attract funds.

Cost Of Labor

The total amount of wages and benefits paid to employees for their work.

Isocost Line

A graph that shows all possible combinations of capital and labor that can be purchased for a given total cost.

Total Cost

The total amount of all costs associated with the creation of goods or services, encompassing both constant and changing expenses.

Q17: Parent Corporation acquired some of its subsidiary's

Q26: Sinkal Co. was formed on January 1,

Q42: On February 23, 2013, Cleveland, Inc. paid

Q43: Which of the following statements is true

Q44: Foreign companies whose stock is listed on

Q60: Partnerships have alternative legal forms including all

Q65: How would consolidated earnings per share be

Q82: A U.S. company sells merchandise to a

Q96: Natarajan, Inc. had the following operating segments,

Q104: Ryan Company owns 80% of Chase Company.