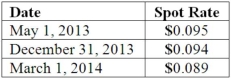

On May 1, 2013, Mosby Company received an order to sell a machine to a customer in Canada at a price of 2,000,000 Mexican pesos. The machine was shipped and payment was received on March 1, 2014. On May 1, 2013, Mosby purchased a put option giving it the right to sell 2,000,000 pesos on March 1, 2014 at a price of $190,000. Mosby properly designates the option as a fair value hedge of the peso firm commitment. The option cost $3,000 and had a fair value of $3,200 on December 31, 2013. The following spot exchange rates apply:  Mosby's incremental borrowing rate is 12 percent, and the present value factor for two months at a 12 percent annual rate is .9803.

Mosby's incremental borrowing rate is 12 percent, and the present value factor for two months at a 12 percent annual rate is .9803.

What was the overall result of having entered into this hedge of exposure to foreign exchange risk?

Definitions:

Q7: The partners of Donald, Chief & Berry

Q10: Which of the following is not true

Q12: Dean, Inc. owns 90 percent of Ralph,

Q16: What is the purpose of a predistribution

Q37: The dissolution of a partnership occurs<br>A) only

Q38: Parent Corporation acquired some of its subsidiary's

Q42: Delta Corporation owns 90 percent of Sigma

Q65: What is included in Part I of

Q88: Car Corp. (a U.S.-based company) sold parts

Q104: The benefits of filing a consolidated tax