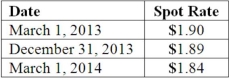

On March 1, 2013, Mattie Company received an order to sell a machine to a customer in England at a price of 200,000 British pounds. The machine was shipped and payment was received on March 1, 2014. On March 1, 2013, Mattie purchased a put option giving it the right to sell 200,000 British pounds on March 1, 2014 at a price of $380,000. Mattie properly designates the option as a fair hedge of the pound firm commitment. The option cost $2,000 and had a fair value of $2,200 on December 31, 2013. The following spot exchange rates apply:  Mattie's incremental borrowing rate is 12 percent, and the present value factor for two months at a 12 percent annual rate is .9803.

Mattie's incremental borrowing rate is 12 percent, and the present value factor for two months at a 12 percent annual rate is .9803.

What was the net impact on Mattie's 2013 income as a result of this fair value hedge of a firm commitment?

Definitions:

Plantation

An early word for a colony, a settlement “planted” from abroad among an alienpopulation in Ireland or the New World. Later, a large agricultural enterprise that used unfree laborto produce a crop for the world market.

Nat Turner

An enslaved African American preacher who led a four-day rebellion of enslaved and free black people in Southampton County, Virginia in 1831.

Religious Man

A person, typically male, who lives in accordance with the beliefs, practices, and ethical values of his religion.

Public Debate

A discussion or argumentation among citizens or public figures on issues of societal concern.

Q6: What were the major objectives of the

Q7: What are the responsibilities of the SEC's

Q7: A partnership began its first year of

Q15: Woolsey Corporation, a U.S. company, expects to

Q46: Cleary, Wasser, and Nolan formed a partnership

Q48: Ryan Company owns 80% of Chase Company.

Q48: Which statement is false regarding the Public

Q55: The following items are required to be

Q72: How has the SEC exercised its power

Q90: Delta Corporation owns 90 percent of Sigma