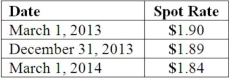

On March 1, 2013, Mattie Company received an order to sell a machine to a customer in England at a price of 200,000 British pounds. The machine was shipped and payment was received on March 1, 2014. On March 1, 2013, Mattie purchased a put option giving it the right to sell 200,000 British pounds on March 1, 2014 at a price of $380,000. Mattie properly designates the option as a fair hedge of the pound firm commitment. The option cost $2,000 and had a fair value of $2,200 on December 31, 2013. The following spot exchange rates apply:  Mattie's incremental borrowing rate is 12 percent, and the present value factor for two months at a 12 percent annual rate is .9803.

Mattie's incremental borrowing rate is 12 percent, and the present value factor for two months at a 12 percent annual rate is .9803.

What was the net increase or decrease in cash flow from having purchased the foreign currency option to hedge this exposure to foreign exchange risk?

Definitions:

Amphetamines

A class of stimulant drugs that can increase energy and concentration but also carry the risk of addiction and adverse health effects.

Morphine

A highly addictive substance derived from opium that is particularly effective in relieving pain.

Cocaine

A powerful stimulant drug derived from the leaves of the coca plant, known for its addictive properties and high potential for abuse.

Crashing

Refers to an abrupt failure or severe downturn, often used to describe sudden declines in financial markets or when a computer system stops functioning unexpectedly.

Q7: The Rivers Co. had four separate operating

Q16: Where is the disposition of a translation

Q21: What are the six key FASB initiatives

Q23: Which one of the following forms is

Q34: What would differ between a statement of

Q40: Peter, Roberts, and Dana have the following

Q45: When must Form 8-K be filed with

Q76: Parker Corp., a U.S. company, had the

Q77: Which two items of information must be

Q119: X-Beams Inc. owned 70% of the voting