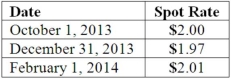

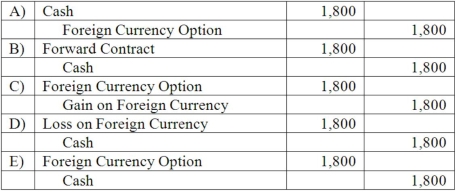

On October 1, 2013, Eagle Company forecasts the purchase of inventory from a British supplier on February 1, 2014, at a price of 100,000 British pounds. On October 1, 2013, Eagle pays $1,800 for a three-month call option on 100,000 pounds with a strike price of $2.00 per pound. The option is considered to be a cash flow hedge of a forecasted foreign currency transaction. On December 31, 2013, the option has a fair value of $1,600. The following spot exchange rates apply:  What journal entry should Eagle prepare on October 1, 2013?

What journal entry should Eagle prepare on October 1, 2013?

Definitions:

Ethical Decision-Making

The process of evaluating and choosing among alternatives in a manner consistent with ethical principles.

Ethical Codes

Ethical codes are a set of guidelines and principles designed to guide the behavior and decision-making of professionals within a specific field.

Moral Model

This refers to a conceptual framework that emphasizes ethical and moral principles as the basis for determining right and wrong behavior.

Job Performance

The effectiveness and efficiency with which an individual fulfills their work-related tasks and responsibilities.

Q8: Primo Inc., a U.S. company, ordered parts

Q12: Norr and Caylor established a partnership on

Q19: Dilty Corp. owned a subsidiary in France.

Q25: What information is required in proxy statements?<br>(1)

Q31: To what does the term Chapter 11

Q47: A company had common stock with a

Q55: How does the existence of a non-controlling

Q60: Gunther Co. established a subsidiary in Mexico

Q70: Hampton Company is trying to decide whether

Q111: What related items need to be disclosed