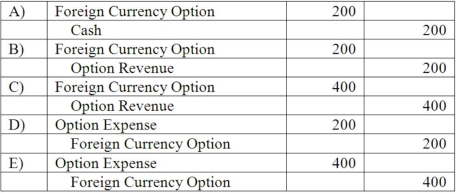

On October 1, 2013, Eagle Company forecasts the purchase of inventory from a British supplier on February 1, 2014, at a price of 100,000 British pounds. On October 1, 2013, Eagle pays $1,800 for a three-month call option on 100,000 pounds with a strike price of $2.00 per pound. The option is considered to be a cash flow hedge of a forecasted foreign currency transaction. On December 31, 2013, the option has a fair value of $1,600. The following spot exchange rates apply:  What journal entry should Eagle prepare on December 31, 2013?

What journal entry should Eagle prepare on December 31, 2013?

Definitions:

Social Trap

Situations in which actions that produce rewards for one individual or group in the short term lead to negative consequences for all in the long term.

Fuel-Inefficient Car

A vehicle that consumes a high amount of fuel relative to the distance it travels, reflecting poor energy efficiency.

Greenhouse Gases

Gases in Earth's atmosphere that trap heat, such as carbon dioxide and methane, contributing to global warming and climate change.

Bystander Effect

An occurrence in social psychology where the presence of others decreases an individual's likelihood to aid someone in need.

Q5: Kennedy Company acquired all of the outstanding

Q37: As of January 1, 2013, the partnership

Q49: Which one of the following requires the

Q49: Stark Company, a 90% owned subsidiary of

Q50: Assuming all of the following expenses have

Q57: Cleary, Wasser, and Nolan formed a partnership

Q68: Which of the following is not an

Q74: Which one of the following is not

Q96: Natarajan, Inc. had the following operating segments,

Q97: A historical exchange rate for common stock