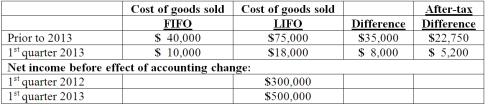

Baker Corporation changed from the LIFO method to the FIFO method for inventory valuation during 2013. Baker has an effective income tax rate of 30 percent and 100,000 shares of common stock issued and outstanding. The following additional information is available:  Assuming Baker makes the change in the first quarter of 2013, how much is reported as net income for the first quarter of 2013?

Assuming Baker makes the change in the first quarter of 2013, how much is reported as net income for the first quarter of 2013?

Definitions:

Short Run

Describes a period during which at least one factor of production is fixed, limiting the ability of a firm to adjust to changes in market demand or supply conditions.

Baking Supplies

Baking supplies encompass all tools, ingredients, and materials used in baking, ranging from flour and sugar to ovens and mixing tools.

Fixed Cost

Any cost that in total does not change when the firm changes its output.

Harvest Labor

The workforce engaged in the process of gathering ripe crops from the fields.

Q19: Dilty Corp. owned a subsidiary in France.

Q22: Walsh Company sells inventory to its subsidiary,

Q46: Brisco Bricks purchases raw material from its

Q48: What information is included on the statement

Q60: Which topic was not covered by FASB

Q69: Which information is not contained in the

Q75: Natarajan, Inc. had the following operating segments,

Q80: What happens when a U.S. company purchases

Q92: A U.S. company buys merchandise from a

Q93: When preparing a consolidating statement of cash