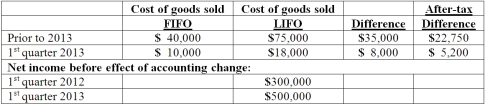

Baker Corporation changed from the LIFO method to the FIFO method for inventory valuation during 2013. Baker has an effective income tax rate of 30 percent and 100,000 shares of common stock issued and outstanding. The following additional information is available:  Assuming Baker makes the change in the first quarter of 2013, compute net income per common share.

Assuming Baker makes the change in the first quarter of 2013, compute net income per common share.

Definitions:

Output of Zero

A theoretical condition or benchmark where no goods or services are being produced or output is completely halted.

Average Total Cost

The cost per unit represented by dividing the entire production cost by the quantity of units produced.

Price of Labor

The wage rate or compensation paid to employees for their work or services.

Units of Output

The quantity or number of items produced or services rendered in a given time period.

Q11: On January 1, 2013, Musial Corp. sold

Q15: How are intra-entity inventory transfers treated on

Q18: Quadros Inc., a Portuguese firm was acquired

Q19: Evanston Co. owned 60% of Montgomery Corp.

Q39: Strickland Company sells inventory to its parent,

Q58: Faru Co. identified five industry segments: (1)

Q58: On January 1, 2013, Pride, Inc. acquired

Q62: Prescott Corp. owned 90% of Bell Inc.,

Q75: When consolidating a subsidiary that was acquired

Q114: McGuire Company acquired 90 percent of Hogan