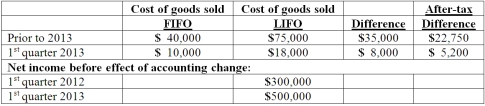

Baker Corporation changed from the LIFO method to the FIFO method for inventory valuation during 2013. Baker has an effective income tax rate of 30 percent and 100,000 shares of common stock issued and outstanding. The following additional information is available:  Assuming Baker makes the change in the first quarter of 2013 and that $400,000 net income is earned during the second quarter, how much is reported as net income for the second quarter of 2013?

Assuming Baker makes the change in the first quarter of 2013 and that $400,000 net income is earned during the second quarter, how much is reported as net income for the second quarter of 2013?

Definitions:

Current Asset

Resources anticipated to be changed into cash, disposed of, or used up either within a year or over the course of the business's usual operational cycle, depending on which timeframe extends further.

Revenue

The total amount of income generated by the sale of goods or services related to a company's core business activities.

Net Income

The total profit of a company after all expenses, including taxes and operating expenses, have been subtracted from total revenue.

Accounts Payable

Money owed by a company to its creditors for goods and services that have been received but not yet paid for.

Q22: A variable interest entity can take all

Q26: How is the presentation of a balance

Q33: On April 1, 2012, Shannon Company, a

Q36: What is the IOSCO?

Q39: Pell Company acquires 80% of Demers Company

Q47: West Corp. owned 70% of the voting

Q49: MacHeath Inc. bought 60% of the outstanding

Q78: On January 1, 2013, a subsidiary buys

Q80: What is the purpose of the adjustments

Q95: Which of the following statements is true