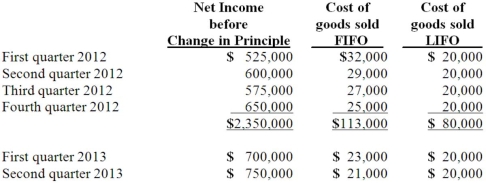

Harrison Company, Inc. began operations on January 1, 2012, and applied the LIFO method for inventory valuation. On June 10, 2013, Harrison adopted the FIFO method of accounting for inventory. Additional information is as follows:

The LIFO method was applied during the first quarter of 2013 and the FIFO method was applied during the second quarter of 2013 in computing income, above. Harrison's effective income tax rate is 40 percent. Harrison has 500,000 shares of common stock outstanding at all times.

Compute the after-tax effect of Harrison's change in inventory method.

Definitions:

Consolidated Income

The total net income of a parent company and its subsidiaries, after accounting for the ownership interest of noncontrolling shareholders.

Income Tax Rate

The percentage at which an individual or corporation is taxed on their income.

Accrual-Based Net Income

The measure of a company's financial performance that includes both cash and non-cash items, recognizing revenues when they are earned and expenses when they are incurred.

Operating Income

Income generated from the regular business operations of a company, excluding items such as investment income, interest expense, and other non-operational income or expenses.

Q17: Kennedy Company acquired all of the outstanding

Q22: On January 1, 2012, Cale Corp. paid

Q27: Gentry Inc. acquired 100% of Gaspard Farms

Q28: What is shelf registration?<br>A) a procedure that

Q29: Esposito is an Italian subsidiary of a

Q45: Lawrence Company, a U.S. company, ordered parts

Q56: The IASB and FASB are working on

Q70: Retro Corp. was engaged solely in manufacturing

Q84: On March 1, 2013, Mattie Company received

Q99: On January 1, 2013, Riley Corp. acquired