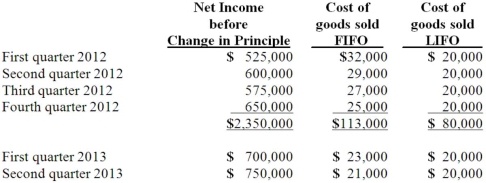

Harrison Company, Inc. began operations on January 1, 2012, and applied the LIFO method for inventory valuation. On June 10, 2013, Harrison adopted the FIFO method of accounting for inventory. Additional information is as follows:

The LIFO method was applied during the first quarter of 2013 and the FIFO method was applied during the second quarter of 2013 in computing income, above. Harrison's effective income tax rate is 40 percent. Harrison has 500,000 shares of common stock outstanding at all times.

Prepare a schedule showing the calculation of net income and earnings per share to be reported by Harrison for the three-month period and the six-month period ended June 30, 2012 and 2013.

Definitions:

Final Distribution

The process of allocating the remaining assets or earnings of a company, fund, or estate to the entitled recipients after all obligations have been met.

Hybrid Form

A blending of two or more different structures or types, often referring to a mix of elements in business, legal, or organizational forms.

Limited Liability Partnership

A partnership arrangement that limits the liability of its partners to their contributions to the business, protecting personal assets.

"S" Corporation

A type of corporation in the United States that meets specific Internal Revenue Code requirements, allowing profits to be taxed only at the shareholder level, not at the corporate level.

Q6: What is a company's functional currency?<br>A) the

Q7: To what does the term Chapter 7

Q9: Boerkian Co. started 2013 with two assets:

Q20: Why was the Public Utility Holding Company

Q25: McGuire Company acquired 90 percent of Hogan

Q60: What are the four interconnected goals that

Q63: Royce Co. acquired 60% of Park Co.

Q64: Which one of the following forms is

Q88: In a father-son-grandson combination, which of the

Q90: Rojas Co. owned 7,000 shares (70%) of