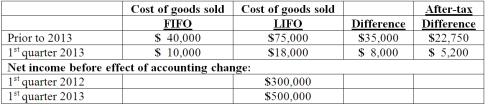

Baker Corporation changed from the LIFO method to the FIFO method for inventory valuation during 2013. Baker has an effective income tax rate of 30 percent and 100,000 shares of common stock issued and outstanding. The following additional information is available:  Assuming Baker makes the change in the first quarter of 2013, how much is reported as net income for the first quarter of 2013?

Assuming Baker makes the change in the first quarter of 2013, how much is reported as net income for the first quarter of 2013?

Definitions:

Level of Attractiveness

A subjective assessment of how appealing, desirable, or aesthetically pleasing someone or something is perceived to be.

Self-Disclosure

The act of revealing personal information to others, which can build intimacy and trust in relationships.

More Conflict

Refers to an increase in disagreement, competition, or discord between individuals or groups, often characterized by tension and opposition.

Interpersonal Attraction

A positive attitude held by one person toward another person.

Q6: Patti Company owns 80% of the common

Q10: Strickland Company sells inventory to its parent,

Q26: Sinkal Co. was formed on January 1,

Q41: Quadros Inc., a Portuguese firm was acquired

Q44: On January 1, 2012, Smeder Company, an

Q47: Which method of translating a foreign subsidiary's

Q49: What is the purpose of the U.S.

Q50: A U.S. company has many foreign subsidiaries

Q55: Paris, Inc. owns 80 percent of the

Q68: Hambly Corp. owned 80% of the voting