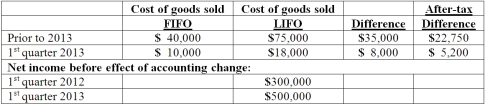

Baker Corporation changed from the LIFO method to the FIFO method for inventory valuation during 2013. Baker has an effective income tax rate of 30 percent and 100,000 shares of common stock issued and outstanding. The following additional information is available:  Assuming Baker makes the change in the first quarter of 2013, compute net income per common share.

Assuming Baker makes the change in the first quarter of 2013, compute net income per common share.

Definitions:

Escape Response

A behavioral response to an aversive event that is reinforced by the termination of the aversive event.

Punishment

The introduction of a consequence in response to a behavior with the intent to decrease the likelihood of that behavior occurring in the future.

Suppressive Influence

The impact or effect that reduces, inhibits, or diminishes a particular response, activity, or expression.

Mowrer

A psychologist known for his two-factor theory of avoidance learning, which combines classical and operant conditioning theories to explain how anxiety and phobias are learned and maintained.

Q29: Paris, Inc. owns 80 percent of the

Q44: Pell Company acquires 80% of Demers Company

Q49: A parent acquires 70% of a subsidiary's

Q57: Pell Company acquires 80% of Demers Company

Q76: On January 1, 2013, Nichols Company acquired

Q82: Pell Company acquires 80% of Demers Company

Q82: A parent acquires all of a subsidiary's

Q93: When is the gain on an intra-entity

Q101: Pell Company acquires 80% of Demers Company

Q117: On January 1, 2013, Payton Co. sold