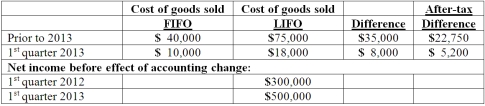

Baker Corporation changed from the LIFO method to the FIFO method for inventory valuation during 2013. Baker has an effective income tax rate of 30 percent and 100,000 shares of common stock issued and outstanding. The following additional information is available:  Assuming Baker makes the change in the first quarter of 2012, how much is reported as net income for the first quarter of 2012?

Assuming Baker makes the change in the first quarter of 2012, how much is reported as net income for the first quarter of 2012?

Definitions:

Supplemental Nutrition Assistance Program

The Supplemental Nutrition Assistance Program (SNAP) is a federal assistance program in the United States that provides food-purchasing assistance for low- and no-income people.

Cash-Vouchers

These are instruments provided to individuals or entities which can be exchanged for goods or services instead of using actual cash.

Income Equality

The equal distribution of income among all members of society, aiming to reduce economic disparities.

Q9: Pell Company acquires 80% of Demers Company

Q22: Which one of the following forms is

Q41: Quadros Inc., a Portuguese firm was acquired

Q46: Which of the following statements is false

Q47: A company sells a building to a

Q55: What exchange rate would be used to

Q70: Perch Co. acquired 80% of the common

Q89: Pell Company acquires 80% of Demers Company

Q97: A historical exchange rate for common stock

Q115: Pell Company acquires 80% of Demers Company