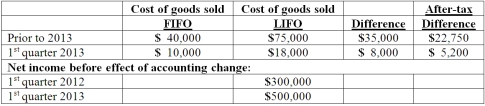

Baker Corporation changed from the LIFO method to the FIFO method for inventory valuation during 2013. Baker has an effective income tax rate of 30 percent and 100,000 shares of common stock issued and outstanding. The following additional information is available:  Assuming Baker makes the change in the first quarter of 2013 and that $400,000 net income is earned during the second quarter, how much is reported as net income for the second quarter of 2013?

Assuming Baker makes the change in the first quarter of 2013 and that $400,000 net income is earned during the second quarter, how much is reported as net income for the second quarter of 2013?

Definitions:

Resources

Assets, materials, and other inputs required by organizations or individuals to produce goods or services.

Equipment

The necessary items for a particular purpose or task, typically involving machinery, tools, or devices required in a professional or recreational activity.

Staffing

The process of identifying, evaluating, and selecting individuals for roles within an organization, ensuring the right fit between the job and the employee.

Cognitively Diverse

Refers to a group characterized by differences in their modes of thinking, problem-solving skills, and ways of processing information.

Q9: Dean Hardware, Inc. is comprised of five

Q19: What are the two major types of

Q51: Perez Company, a Mexican subsidiary of a

Q57: On February 23, 2013, Cleveland, Inc. paid

Q69: Quadros Inc., a Portuguese firm was acquired

Q73: Natarajan, Inc. had the following operating segments,

Q80: Which of the following is not correct

Q82: A parent acquires all of a subsidiary's

Q83: What is the meaning of the phrase

Q117: On January 1, 2013, Payton Co. sold