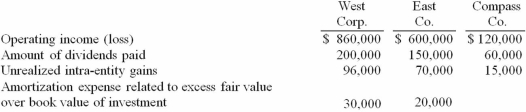

West Corp. owned 70% of the voting common stock of East Co. East owned 60% of Compass Co. West and East both used the initial value method to account for their investments. The following information was available from the financial statements and records of the three companies:  Operating income included unrealized intra-entity gains (which are related to inventory transfers) but did not include dividend income from investment in subsidiary.

Operating income included unrealized intra-entity gains (which are related to inventory transfers) but did not include dividend income from investment in subsidiary.

What amount should have been reported for consolidated net income?

Definitions:

Philosophical Tradition

A historical school of thought or a set of doctrines that shapes the field of philosophy.

Religious Rituals

Ceremonial acts followed in religious practices, often symbolic in nature, aimed at fostering spiritual experiences or honor deities.

Ibn-Rushd

A medieval Andalusian polymath known in the Western world as Averroes, who made significant contributions to philosophy, theology, and medicine.

Al-Farabi

A renowned philosopher and scientist in the Islamic golden age, who made notable contributions in philosophy, logic, and music.

Q2: McGuire Company acquired 90 percent of Hogan

Q11: In countries of Latin America:<br>A) accounting practice

Q25: Strayten Corp. is a wholly owned subsidiary

Q46: Cashen Co. paid $2,400,000 to acquire all

Q56: Quadros Inc., a Portuguese firm was acquired

Q59: What term is used for a bankruptcy

Q71: Bazley Co. had severe financial difficulties and

Q79: What is meant by unrealized inventory gains,

Q87: Royce Co. acquired 60% of Park Co.

Q108: Alpha Corporation owns 100 percent of Beta