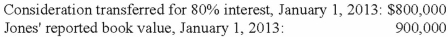

On January 1, 2012, Jones Company bought 15% of Whitton Company. Jones paid $150,000 for these shares, an amount that exactly equaled the proportionate book value of Whitton. On January 1, 2013, Whitton acquired 80% ownership of Jones. The following data are available concerning Whitton's acquisition of Jones:  Excess fair value over book value (assigned to trademarks) is amortized over 20 years.

Excess fair value over book value (assigned to trademarks) is amortized over 20 years.

The initial value method is used by both companies.

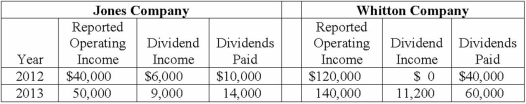

The following information is available regarding Jones and Whitton:

Compute the amount allocated to trademarks recognized in the January 1, 2013 consolidated balance sheet.

Definitions:

Triceps Reflex

A deep tendon reflex tested by striking the triceps tendon, located just above the elbow, to assess the spinal cord's response function in the neck area.

Flexion

The act of bending a joint or limb in the body, decreasing the angle between the bones of the limb at the joint.

Extension

The movement by which the angle between two adjoining parts of the body is increased; opposite of flexion.

Hyperesthesia

An increased sensitivity to stimulation, particularly touch.

Q32: What is the appropriate treatment in an

Q43: Wilson owned equipment with an estimated life

Q47: Lechter Co. is preparing to issue stock.

Q55: On January 1, 2012, Franel Co. acquired

Q56: Prince Corp. owned 80% of Kile Corp.'s

Q61: How are the operations of the SEC

Q72: An intra-entity sale took place whereby the

Q75: Perry Company acquires 100% of the stock

Q75: Natarajan, Inc. had the following operating segments,

Q86: On January 1, 2013, Musial Corp. sold