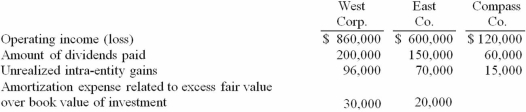

West Corp. owned 70% of the voting common stock of East Co. East owned 60% of Compass Co. West and East both used the initial value method to account for their investments. The following information was available from the financial statements and records of the three companies:  Operating income included unrealized intra-entity gains (which are related to inventory transfers) but did not include dividend income from investment in subsidiary.

Operating income included unrealized intra-entity gains (which are related to inventory transfers) but did not include dividend income from investment in subsidiary.

The accrual-based income of East Co. is calculated to be

Definitions:

Interest Payments

The regular payments made to lenders as compensation for the money borrowed, typically expressed as a percentage of the principal sum.

Debt Ceiling

A limit on the total amount of money the federal government can legally borrow.

Defense Spending

Government expenditure on military and defense-related activities, including salaries, equipment, operations, and research and development.

Budget Deficit

A financial situation where a government's expenditures exceed its revenues over a specified period, leading to borrowing or debt accumulation.

Q7: Ryan Company owns 80% of Chase Company.

Q10: What is blue sky legislation?

Q16: Larson Company, a U.S. company, has an

Q23: Thomas Inc. had the following stockholders' equity

Q28: Stiller Company, an 80% owned subsidiary of

Q32: Thomas Inc. had the following stockholders' equity

Q69: On January 1, 2012, Franel Co. acquired

Q74: On January 1, 2014, Glenville Co. acquired

Q97: What method is used in consolidation to

Q98: Yukon Co. acquired 75% percent of the