These questions are based on the following information and should be viewed as independent situations.

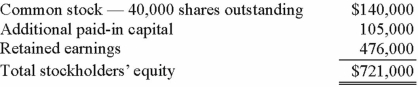

Popper Co. acquired 80% of the common stock of Cocker Co. on January 1, 2011, when Cocker had the following stockholders' equity accounts.

To acquire this interest in Cocker, Popper paid a total of $682,000 with any excess acquisition date fair value over book value being allocated to goodwill, which has been measured for impairment annually and has not been determined to be impaired as of January 1, 2014.

On January 1, 2014, Cocker reported a net book value of $1,113,000 before the following transactions were conducted. Popper uses the equity method to account for its investment in Cocker, thereby reflecting the change in book value of Cocker.

On January 1, 2014, Cocker issued 10,000 additional shares of common stock for $35 per share. Popper acquired 8,000 of these shares. How would this transaction affect the additional paid-in capital of the parent company?

Definitions:

Competencies

Refers to the skills, knowledge, and abilities that are required for the successful performance of a job or task.

Behavioral Component

Refers to the actions or observable responses of a person associated with an attitude, belief, or knowledge.

Intention

A mental state that represents a commitment to carrying out an action or actions in the future.

Expressing

Involves the action of conveying thoughts, feelings, or information to others.

Q11: The forward rate may be defined as<br>A)

Q19: Car Corp. (a U.S.-based company) sold parts

Q27: Parker owned all of Odom Inc. Although

Q32: A foreign subsidiary was acquired on January

Q38: A forward contract may be used for

Q49: Under the current rate method, property, plant

Q52: How is the fair value of a

Q61: Under the current rate method, inventory at

Q68: Watkins, Inc. acquires all of the outstanding

Q71: When a subsidiary is acquired sometime after