These questions are based on the following information and should be viewed as independent situations.

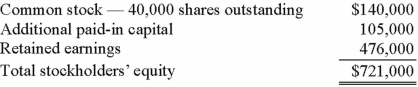

Popper Co. acquired 80% of the common stock of Cocker Co. on January 1, 2011, when Cocker had the following stockholders' equity accounts.

To acquire this interest in Cocker, Popper paid a total of $682,000 with any excess acquisition date fair value over book value being allocated to goodwill, which has been measured for impairment annually and has not been determined to be impaired as of January 1, 2014.

On January 1, 2014, Cocker reported a net book value of $1,113,000 before the following transactions were conducted. Popper uses the equity method to account for its investment in Cocker, thereby reflecting the change in book value of Cocker.

On January 1, 2014, Cocker reacquired 8,000 of the outstanding shares of its own common stock for $34 per share. None of these shares belonged to Popper. How would this transaction have affected the additional paid-in capital of the parent company?

Definitions:

Passive Communication

A form of communication where the communicator fails to express their needs or feelings directly.

Directive Communication

A style of communication where instructions, commands, or directions are given clearly and directly.

Spontaneous Judgments

Immediate assessments or decisions made without premeditation or extended deliberation.

Nonverbal Cues

Forms of non-linguistic communications, such as body language, gestures, facial expressions, and tone of voice, that transmit messages without words.

Q27: On May 1, 2013, Mosby Company received

Q28: Stiller Company, an 80% owned subsidiary of

Q34: What would differ between a statement of

Q35: A foreign subsidiary uses the first-in first-out

Q41: Quadros Inc., a Portuguese firm was acquired

Q48: Ryan Company owns 80% of Chase Company.

Q58: Which of the following statements is true

Q106: Walsh Company sells inventory to its subsidiary,

Q114: When indirect control is present, which of

Q118: An acquisition transaction results in $90,000 of