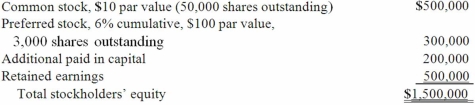

On January 1, 2013, Nichols Company acquired 80% of Smith Company's common stock and 40% of its non-voting, cumulative preferred stock. The consideration transferred by Nichols was $1,200,000 for the common and $124,000 for the preferred. Any excess acquisition-date fair value over book value is considered goodwill. The capital structure of Smith immediately prior to the acquisition is:  Compute the non-controlling interest in Smith at date of acquisition.

Compute the non-controlling interest in Smith at date of acquisition.

Definitions:

Motorcycle Seats

Components of a motorcycle designed to provide a rider and possibly a passenger with a comfortable place to sit while riding.

Supply Partnership

A collaborative agreement between a supplier and a buyer to ensure products or services are available at the right time, quality, and price.

Mutually Beneficial Objectives

Goals or intentions that provide advantages or positive outcomes for all parties involved in a particular situation or agreement.

Policies

Formal guidelines or rules set by an organization to regulate and guide decisions and actions in various scenarios.

Q3: Which of the following characteristics is not

Q21: Velway Corp. acquired Joker Inc. on January

Q22: On January 1, 2012, Cale Corp. paid

Q40: Beta Corp. owns less than one hundred

Q51: On January 1, 2013, Harrison Corporation spent

Q58: What is the primary accounting difference between

Q68: Hambly Corp. owned 80% of the voting

Q75: Boerkian Co. started 2013 with two assets:

Q110: Campbell Inc. owned all of Gordon Corp.

Q113: Which one of the following items must