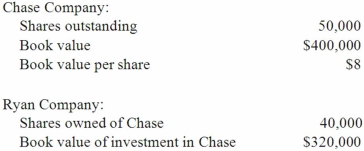

Ryan Company owns 80% of Chase Company. The original balances presented for Ryan and Chase as of January 1, 2013, are as follows:  Assume Chase issues 30,000 additional shares common stock solely to Ryan for $12 per share.

Assume Chase issues 30,000 additional shares common stock solely to Ryan for $12 per share.

After acquiring the additional shares, what adjustment is needed for Ryan's investment in Chase account?

Definitions:

Annual Sales

The total revenue generated from the sale of goods or services over the course of a year.

CCA Class

A categorization within the Canadian taxation system specifying the depreciation rate applicable to different types of property or equipment for tax purposes.

Net Present Value

A calculation that determines the present value of an investment's expected cash flows, minus the initial investment cost, taking into account the time value of money.

Marginal Tax Rate

The rate at which the last dollar of a taxpayer’s income is taxed, indicating the percentage of tax applied to their income for each tax bracket in which they qualify.

Q23: White Company owns 60% of Cody Company.

Q29: Pepe, Incorporated acquired 60% of Devin Company

Q30: For each of the following situations, select

Q38: When comparing the difference between an upstream

Q40: Esposito is an Italian subsidiary of a

Q53: How is the gain on an intra-entity

Q57: Push-down accounting is concerned with the<br>A) impact

Q84: Norek Corp. owned 70% of the voting

Q93: Parent Corporation acquired some of its subsidiary's

Q108: Patti Company owns 80% of the common