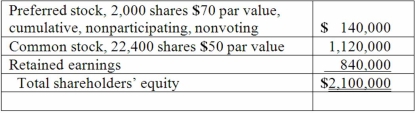

On January 1, 2013, Bast Co. had a net book value of $2,100,000 as follows:

Fisher Co. acquired all of the outstanding preferred shares for $148,000 and 60% of the common stock for $1,281,000. Fisher believed that one of Bast's buildings, with a twelve-year life, was undervalued on the company's financial records by $70,000.

Required:

What is the amount of goodwill to be recognized from this purchase?

Definitions:

Late Majority

A group of consumers in the technology adoption lifecycle that is slower than the average population to adopt new products or innovations, often requiring evidence of benefits and lower risk.

Competitive Products

Goods or services that rival others in the same market, often through differentiation in features, pricing, quality, or brand reputation.

Test Marketing Phase

A stage in product development where the product is marketed on a limited scale to assess consumer reaction.

Panel Data

Information collected from a group of consumers.

Q4: Pell Company acquires 80% of Demers Company

Q9: Pell Company acquires 80% of Demers Company

Q16: When consolidating a subsidiary under the equity

Q23: Which of the following statements is true

Q28: At the date of an acquisition which

Q29: On January 1, 2013, Parent Corporation acquired

Q60: Walsh Company sells inventory to its subsidiary,

Q65: When preparing a consolidation worksheet for a

Q86: If a subsidiary issues a stock dividend,

Q86: Bullen Inc. acquired 100% of the voting