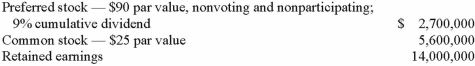

Thomas Inc. had the following stockholders' equity accounts as of January 1, 2013:

Kuried Co. acquired all of the voting common stock of Thomas on January 1, 2013, for $20,656,000. The preferred stock remained in the hands of outside parties and had a fair value of $3,060,000. A database valued at $656,000 was recognized and amortized over five years.

During 2013, Thomas reported earning $630,000 in net income and paid $504,000 in total cash dividends. Kuried used the equity method to account for this investment.

Prepare all consolidation entries for 2013.

Definitions:

Incremental Basis

A method of calculating changes in costs or benefits that result from small variations in the quantity of output or input.

Differential Basis

A method of calculating or analyzing the difference in costs or revenues between two alternative actions.

Sunk Cost

A cost that cannot be changed by any present or future decision.

Book Value

The difference between the cost of a depreciable asset and its related accumulated depreciation.

Q29: In comparing U.S. GAAP and international financial

Q31: Parent sold land to its subsidiary for

Q37: When consolidating a subsidiary under the equity

Q53: On January 1, 2013, Chester Inc. acquired

Q64: Perry Company acquires 100% of the stock

Q67: Gregor Inc. uses the LIFO cost-flow assumption

Q70: Retro Corp. was engaged solely in manufacturing

Q70: Tray Co. reported current earnings of $560,000

Q100: Which of the following statements is true

Q104: The benefits of filing a consolidated tax