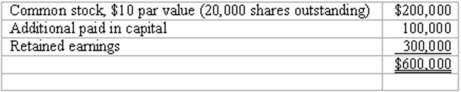

Panton, Inc. acquired 18,000 shares of Glotfelty Corp. several years ago. At the present time, Glotfelty is reporting the following stockholders' equity:

Glotfelty issues 5,000 shares of previously unissued stock to Panton for $35 per share.

Required: Describe how this transaction would affect Panton's books.

The investment price is above the book value of the subsidiary. In this case, however, the additional amount has been paid by the parent company, not by an outside party. Because the payment is made by Panton, the investment account will need an adjustment after recording the cost of the new shares. A change in ownership is accounted for as an equity transaction when controlling interest is retained.

Definitions:

Land Ownership

The legal right, recognized by law, to possess and use a specific parcel of land.

Common Resource

A resource like air, water, or fish stocks, that is not owned privately but is available for use by everyone, often leading to overuse and depletion.

Treaty Negotiations

Treaty negotiations refer to the process of discussions and bargaining between nations or parties to reach a formal agreement that is binding and recognized internationally.

Europeans

People originating from the continent of Europe, characterized by diverse cultures, languages, and histories.

Q1: Webb Co. acquired 100% of Rand Inc.

Q13: On January 1, 2013, Pride, Inc. acquired

Q16: Which of the segments are separately reportable?<br>A)

Q32: McGuire Company acquired 90 percent of Hogan

Q34: A U.S. company buys merchandise from a

Q39: Ginvold Co. began operating a subsidiary in

Q60: A U.S. company sells merchandise to a

Q78: Pell Company acquires 80% of Demers Company

Q88: What is the justification for the remeasurement

Q91: Which of the following is false with