These questions are based on the following information and should be viewed as independent situations.

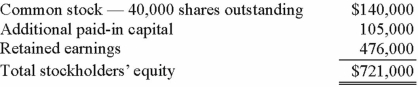

Popper Co. acquired 80% of the common stock of Cocker Co. on January 1, 2011, when Cocker had the following stockholders' equity accounts.

To acquire this interest in Cocker, Popper paid a total of $682,000 with any excess acquisition date fair value over book value being allocated to goodwill, which has been measured for impairment annually and has not been determined to be impaired as of January 1, 2014.

On January 1, 2014, Cocker reported a net book value of $1,113,000 before the following transactions were conducted. Popper uses the equity method to account for its investment in Cocker, thereby reflecting the change in book value of Cocker.

On January 1, 2014, Cocker issued 10,000 additional shares of common stock for $35 per share. Popper acquired 8,000 of these shares. How would this transaction affect the additional paid-in capital of the parent company?

Definitions:

Marginal Cost

The expense incurred in manufacturing an extra unit of a product or service.

Economic Profits

The difference between total revenue and total costs, including both explicit and implicit costs, indicating excess over the opportunity cost.

Minimum Average Total Cost

The lowest point on the curve that shows the average cost of producing each unit of output when all input costs are considered over various output levels.

Marginal Cost

The cost added by producing one additional unit of a product or service.

Q6: Patti Company owns 80% of the common

Q7: One company acquires another company in a

Q7: Quadros Inc., a Portuguese firm was acquired

Q28: Stiller Company, an 80% owned subsidiary of

Q47: McGuire Company acquired 90 percent of Hogan

Q48: Ryan Company owns 80% of Chase Company.

Q74: On January 1, 2014, Glenville Co. acquired

Q78: For each of the following situations, select

Q86: Alpha Corporation owns 100 percent of Beta

Q114: Kaye Company acquired 100% of Fiore Company