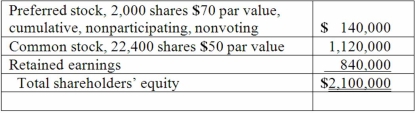

On January 1, 2013, Bast Co. had a net book value of $2,100,000 as follows:

Fisher Co. acquired all of the outstanding preferred shares for $148,000 and 60% of the common stock for $1,281,000. Fisher believed that one of Bast's buildings, with a twelve-year life, was undervalued on the company's financial records by $70,000.

Required:

What is the amount of goodwill to be recognized from this purchase?

Definitions:

Normal Distribution

A bell-shaped probability distribution that is symmetrical about its mean, describing how variables are distributed, indicating that most of the observations cluster around the central peak and the probabilities for values further away from the mean taper off equally in both directions.

Continuous Uniform Probability Distribution

A type of probability distribution where all outcomes in a continuous range are equally likely.

Rectangular

Pertaining to a shape or object whose surface has four right angles and the opposite sides are parallel and equal in length.

Standard Deviation

A measure of the amount of variation or dispersion of a set of values; quantifies the degree to which values differ from the average value.

Q24: Which of the following statements is true

Q39: Provo, Inc. has an estimated annual tax

Q45: On January 1, 2013, Fandu Corp. began

Q47: What is the impact on the non-controlling

Q49: Which of the following statements is true

Q65: Schilling, Inc. has three operating segments with

Q70: Perez Company, a Mexican subsidiary of a

Q90: Rojas Co. owned 7,000 shares (70%) of

Q106: Which of the following is reported for

Q109: River Co. owned 80% of Boat Inc.