On January 1, 2013, Pride, Inc. acquired 80% of the outstanding voting common stock of Strong Corp. for $364,000. There is no active market for Strong's stock. Of this payment, $28,000 was allocated to equipment (with a five-year life) that had been undervalued on Strong's books by $35,000. Any remaining excess was attributable to goodwill which has not been impaired.

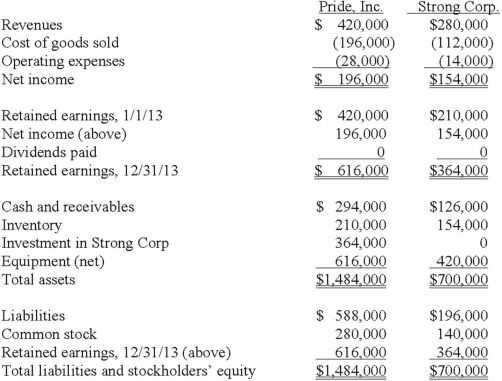

As of December 31, 2013, before preparing the consolidated worksheet, the financial statements appeared as follows:

During 2013, Pride bought inventory for $112,000 and sold it to Strong for $140,000. Only half of this purchase had been paid for by Strong by the end of the year. 60% of these goods were still in the company's possession on December 31, 2013.

What is the total of consolidated revenues?

Definitions:

Higher-Order Conditioning

A process in classical conditioning by which a stimulus that's associated with a conditioned stimulus also becomes capable of eliciting a conditioned response.

Successive Approximations

A method used in behavior modification that rewards behaviors that progressively get closer to the desired behavior.

Intermittent Reinforcement

A conditioning schedule where a response is only sometimes reinforced, leading to more resistant and persistent behavior.

Faster Extinction

The accelerated reduction or loss of conditioned responses, typically in the context of behavioral psychology.

Q4: Woods Company has one depreciable asset valued

Q41: Elektronix, Inc. has three operating segments with

Q55: Paris, Inc. owns 80 percent of the

Q63: Which items of information are required to

Q66: Car Corp. (a U.S.-based company) sold parts

Q67: Coyote Corp. (a U.S. company in Texas)

Q81: What documents or other sources of information

Q92: A U.S. company buys merchandise from a

Q92: Fraker, Inc. owns 90 percent of Richards,

Q114: Stark Company, a 90% owned subsidiary of