On January 1, 2013, Pride, Inc. acquired 80% of the outstanding voting common stock of Strong Corp. for $364,000. There is no active market for Strong's stock. Of this payment, $28,000 was allocated to equipment (with a five-year life) that had been undervalued on Strong's books by $35,000. Any remaining excess was attributable to goodwill which has not been impaired.

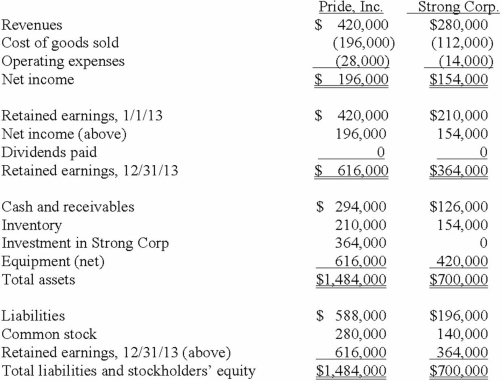

As of December 31, 2013, before preparing the consolidated worksheet, the financial statements appeared as follows:

During 2013, Pride bought inventory for $112,000 and sold it to Strong for $140,000. Only half of this purchase had been paid for by Strong by the end of the year. 60% of these goods were still in the company's possession on December 31, 2013.

What is the consolidated total of non-controlling interest appearing in the balance sheet?

Definitions:

Confide

To trust someone with personal information or a secret, believing that they will not disclose this information to others.

Jerry Maguire Effect

A cultural phenomenon where a person's realization and declaration of love and commitment fundamentally changes their relationships and life, inspired by the movie "Jerry Maguire."

Jean Piaget

A psychologist from Switzerland renowned for his groundbreaking contributions to the study of child development, especially his cognitive development theory.

Paul Ekman

A psychologist renowned for his research on the classification of human emotions and their expression through facial expressions.

Q9: When a company applies the initial method

Q19: Car Corp. (a U.S.-based company) sold parts

Q20: Which tests must a company use to

Q24: Peterman Co. owns 55% of Samson Co.

Q44: On January 1, 2012, Mehan, Incorporated purchased

Q54: Caldwell Inc. acquired 65% of Club Corp.

Q72: An intra-entity sale took place whereby the

Q99: Pell Company acquires 80% of Demers Company

Q114: Which one of the following items is

Q115: On January 1, 2013, Nichols Company acquired