On January 1, 2013, Pride, Inc. acquired 80% of the outstanding voting common stock of Strong Corp. for $364,000. There is no active market for Strong's stock. Of this payment, $28,000 was allocated to equipment (with a five-year life) that had been undervalued on Strong's books by $35,000. Any remaining excess was attributable to goodwill which has not been impaired.

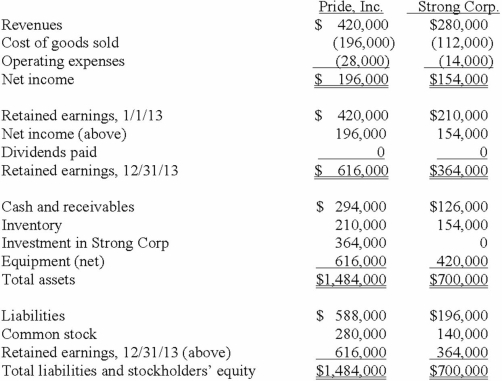

As of December 31, 2013, before preparing the consolidated worksheet, the financial statements appeared as follows:

During 2013, Pride bought inventory for $112,000 and sold it to Strong for $140,000. Only half of this purchase had been paid for by Strong by the end of the year. 60% of these goods were still in the company's possession on December 31, 2013.

What is the consolidated total for equipment (net) at December 31, 2013?

Definitions:

Advil

A brand of over-the-counter medication commonly used to reduce fever, relieve pain, and lessen inflammation; its active ingredient is ibuprofen.

Motrin

A brand of ibuprofen, a non-steroidal anti-inflammatory drug (NSAID) used to relieve pain, reduce inflammation, and lower fever.

Pick's Disease

A rare form of dementia characterized by progressive and irreversible neurological decline, similar to Alzheimer's disease but with distinct pathological features.

Frontal and Temporal Lobes

Regions of the brain responsible for cognitive functions such as thinking, planning, problem-solving (frontal) and auditory processing, memory, and emotion (temporal).

Q24: Strong Company has had poor operating results

Q39: A company has been using the fair-value

Q40: On November 8, 2013, Power Corp. sold

Q44: On January 1, 2012, Mehan, Incorporated purchased

Q75: Perry Company acquires 100% of the stock

Q75: On October 31, 2012, Darling Company negotiated

Q76: Parker Corp., a U.S. company, had the

Q97: On January 1, 2012, Smeder Company, an

Q110: Pell Company acquires 80% of Demers Company

Q112: Which of the following statements is true