On January 1, 2013, Pride, Inc. acquired 80% of the outstanding voting common stock of Strong Corp. for $364,000. There is no active market for Strong's stock. Of this payment, $28,000 was allocated to equipment (with a five-year life) that had been undervalued on Strong's books by $35,000. Any remaining excess was attributable to goodwill which has not been impaired.

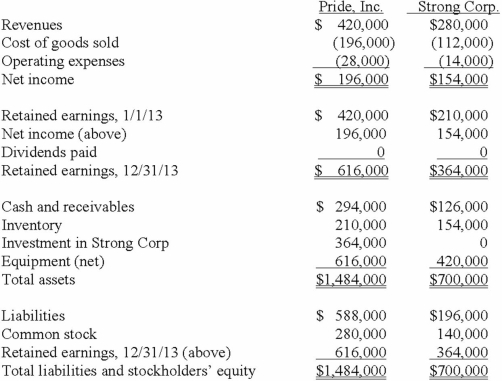

As of December 31, 2013, before preparing the consolidated worksheet, the financial statements appeared as follows:

During 2013, Pride bought inventory for $112,000 and sold it to Strong for $140,000. Only half of this purchase had been paid for by Strong by the end of the year. 60% of these goods were still in the company's possession on December 31, 2013.

What is the consolidated total for inventory at December 31, 2013?

Definitions:

Murders Witnessed

The experience of being a direct observer to the act of murder, which can have profound psychological effects on individuals.

Elementary School Years

The period in a child's education that typically covers grades 1 through 5 or 6, focusing on foundational academic skills.

Television

An electronic system of transmitting moving images and sound from a source to a receiver.

Acts of Violence

Behaviors or actions that involve force or aggression intended to cause harm, injury, or death to others.

Q7: One company acquires another company in a

Q8: Which of the following statements is false

Q27: Pennant Corp. owns 70% of the common

Q48: X Co. owned 80% of Y Corp.,

Q63: Which items of information are required to

Q76: Which one of the following is a

Q78: Pot Co. holds 90% of the common

Q92: Buckette Co. owned 60% of Shuvelle Corp.

Q101: What are the essential criteria for including

Q105: White Company owns 60% of Cody Company.