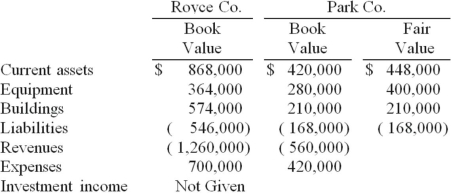

Royce Co. acquired 60% of Park Co. for $420,000 on December 31, 2014 when Park's book value was $560,000. The Royce stock was not actively traded. On the date of acquisition, Park had equipment (with a ten-year life) that was undervalued in the financial records by $140,000. One year later, the following selected figures were reported by the two companies. Additionally, no dividends have been paid.  What is consolidated net income for 2015 attributable to Royce's controlling interest?

What is consolidated net income for 2015 attributable to Royce's controlling interest?

Definitions:

Financial Expertise

Financial expertise refers to a deep understanding and knowledge of financial principles, practices, and analysis, essential for making informed business decisions, managing budgets, and ensuring financial stability.

Ingratiation

Ingratiation is a social strategy where an individual tries to win favor or acceptance from others through flattery or other means of manipulation.

Exchange

The act of giving one thing and receiving another, especially of the same kind, such as goods, services, or ideas, in return.

Political Tactics

Strategies and maneuvers used within organizations to gain advantage or support for specific goals or interests.

Q1: Presented below are the financial balances for

Q3: Steven Company owns 40% of the outstanding

Q10: Strickland Company sells inventory to its parent,

Q20: Sequence-specific PCR using allele-specific primers and primers

Q26: Dodge, Incorporated acquires 15% of Gates Corporation

Q28: For an acquisition when the subsidiary retains

Q32: When should an investor not use the

Q69: Regency Corp. recently acquired $500,000 of the

Q91: During January 2012, Wells, Inc. acquired 30%

Q108: Dean Hardware, Inc. is comprised of five