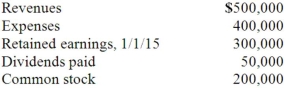

Keefe Inc, a calendar-year corporation, acquires 70% of George Company on September 1, 2014, and an additional 10% on January 1, 2015. Total annual amortization of $6,000 relates to the first acquisition. George reports the following figures for 2015:  Without regard for this investment, Keefe independently earns $300,000 in net income during 2015.

Without regard for this investment, Keefe independently earns $300,000 in net income during 2015.

All net income is earned evenly throughout the year.

What is the controlling interest in consolidated net income for 2015?

Definitions:

Store Of Value

Anything that retains its purchasing power over time.

Double Coincidence

Double Coincidence is a term used in economics to describe a situation where two parties each hold an item the other wants, allowing for an exchange without the need for a common medium of trade, like money.

Barter System

An ancient method of exchange where goods and services are traded directly for other goods and services without using money.

Trade

The exchange of goods, services, or both between two or more parties, either within a country or across international borders.

Q6: Faru Co. identified five industry segments: (1)

Q22: Which of the following methods used to

Q23: Harrison Company, Inc. began operations on January

Q55: Chain Co. owned all of the voting

Q57: Gargiulo Company, a 90% owned subsidiary of

Q58: On January 1, 2012, Mehan, Incorporated purchased

Q74: Steven Company owns 40% of the outstanding

Q91: During January 2012, Wells, Inc. acquired 30%

Q103: What is the primary objective of the

Q108: Alpha Corporation owns 100 percent of Beta