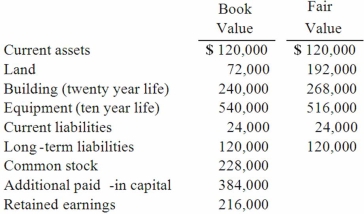

On January 1, 2012, Cale Corp. paid $1,020,000 to acquire Kaltop Co. Kaltop maintained separate incorporation. Cale used the equity method to account for the investment. The following information is available for Kaltop's assets, liabilities, and stockholders' equity accounts on January 1, 2012:  Kaltop earned net income for 2012 of $126,000 and paid dividends of $48,000 during the year.

Kaltop earned net income for 2012 of $126,000 and paid dividends of $48,000 during the year.

At the end of 2012, the consolidation entry to eliminate Cale's accrual of Kaltop's earnings would include a credit to Investment in Kaltop Co. for

Definitions:

Carbon And Glass Fibres

Strong, lightweight materials used in composites for a variety of applications, including automotive parts, sporting goods, and aerospace components.

Depletion Time

The amount of time it takes to fully use up a particular natural resource at the current rate of consumption.

Recycling Measures

Actions and processes dedicated to collecting, processing, and converting waste materials into new products, reducing the need for raw materials and minimizing waste.

Mining

The extraction of valuable minerals or other geological materials from the Earth.

Q5: Horse Corporation acquires all of Pony, Inc.

Q34: What would differ between a statement of

Q36: Gargiulo Company, a 90% owned subsidiary of

Q46: Where should a non-controlling interest appear on

Q54: Flynn acquires 100 percent of the outstanding

Q63: Anderson, Inc. has owned 70% of its

Q74: These questions are based on the following

Q80: Watkins, Inc. acquires all of the outstanding

Q90: Rojas Co. owned 7,000 shares (70%) of

Q102: All of the following are acceptable methods