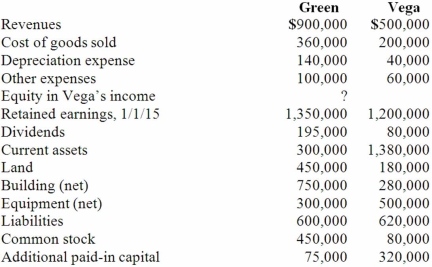

Following are selected accounts for Green Corporation and Vega Company as of December 31, 2015. Several of Green's accounts have been omitted.  Green acquired 100% of Vega on January 1, 2011, by issuing 10,500 shares of its $10 par value common stock with a fair value of $95 per share. On January 1, 2011, Vega's land was undervalued by $40,000, its buildings were overvalued by $30,000, and equipment was undervalued by $80,000. The buildings have a 20-year life and the equipment has a 10-year life. $50,000 was attributed to an unrecorded trademark with a 16-year remaining life. There was no goodwill associated with this investment.

Green acquired 100% of Vega on January 1, 2011, by issuing 10,500 shares of its $10 par value common stock with a fair value of $95 per share. On January 1, 2011, Vega's land was undervalued by $40,000, its buildings were overvalued by $30,000, and equipment was undervalued by $80,000. The buildings have a 20-year life and the equipment has a 10-year life. $50,000 was attributed to an unrecorded trademark with a 16-year remaining life. There was no goodwill associated with this investment.

Compute the December 31, 2015, consolidated revenues.

Definitions:

Wind Farms

Areas equipped with large numbers of wind turbines used to generate electricity.

Fossil Fuels

Natural fuels such as coal, oil, and natural gas derived from the remains of living organisms that have been buried for millions of years.

Migratory Birds

Birds that travel from one region or climate to another at regular times of the year, often for breeding or climate conditions.

Fallacy of Composition

The error of assuming that what is true of a member of a group is true for the group as a whole.

Q3: A fax report of patient results is

Q12: On January 1, 2012, Mehan, Incorporated purchased

Q48: X Co. owned 80% of Y Corp.,

Q56: How would you account for in-process research

Q61: Chase Company owns 80% of Lawrence Company

Q76: When an investor sells shares of its

Q84: Presented below are the financial balances for

Q92: A parent company owns a controlling interest

Q97: What method is used in consolidation to

Q111: Pell Company acquires 80% of Demers Company