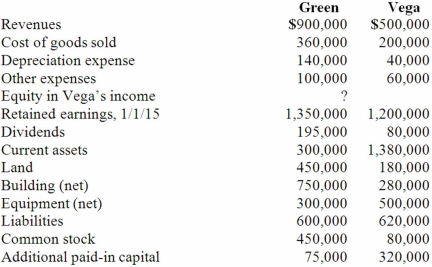

Following are selected accounts for Green Corporation and Vega Company as of December 31, 2015. Several of Green's accounts have been omitted.  Green acquired 100% of Vega on January 1, 2011, by issuing 10,500 shares of its $10 par value common stock with a fair value of $95 per share. On January 1, 2011, Vega's land was undervalued by $40,000, its buildings were overvalued by $30,000, and equipment was undervalued by $80,000. The buildings have a 20-year life and the equipment has a 10-year life. $50,000 was attributed to an unrecorded trademark with a 16-year remaining life. There was no goodwill associated with this investment.

Green acquired 100% of Vega on January 1, 2011, by issuing 10,500 shares of its $10 par value common stock with a fair value of $95 per share. On January 1, 2011, Vega's land was undervalued by $40,000, its buildings were overvalued by $30,000, and equipment was undervalued by $80,000. The buildings have a 20-year life and the equipment has a 10-year life. $50,000 was attributed to an unrecorded trademark with a 16-year remaining life. There was no goodwill associated with this investment.

Compute the December 31, 2015, consolidated additional paid-in capital.

Definitions:

Transportation Costs

Expenses associated with moving goods from one location to another within the supply chain.

Chinese Yuan

The official currency of the People’s Republic of China, which is issued by the People's Bank of China.

Labor Dispute

A disagreement between employees and employers over workplace conditions, wages, hours, or other labor-related issues, often leading to negotiations or strikes.

Risk Driver

Factors that contribute to the level of risk in a project or business situation, influencing the probability and impact of potential risks.

Q4: Li-Fraumeni syndrome, in which affected patients have

Q7: Dice Inc. owns 40% of the outstanding

Q12: A patient with a family history of

Q17: Which of the following translocations results in

Q26: White Company owns 60% of Cody Company.

Q54: Cayman Inc. bought 30% of Maya Company

Q78: Pot Co. holds 90% of the common

Q91: Which one of the following is a

Q92: Pell Company acquires 80% of Demers Company

Q109: On January 1, 2012, Dawson, Incorporated, paid