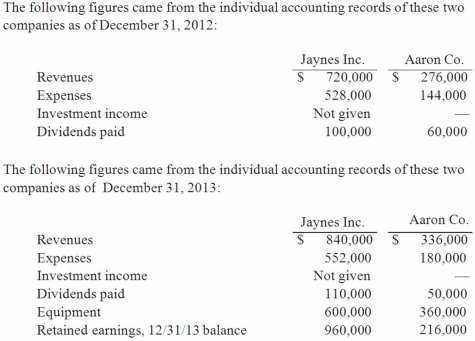

Jaynes Inc. acquired all of Aaron Co.'s common stock on January 1, 2012, by issuing 11,000 shares of $1 par value common stock. Jaynes' shares had a $17 per share fair value. On that date, Aaron reported a net book value of $120,000. However, its equipment (with a five-year remaining life) was undervalued by $6,000 in the company's accounting records. Any excess of consideration transferred over fair value of assets and liabilities is assigned to an unrecorded patent to be amortized over ten years.

What was consolidated net income for the year ended December 31, 2013?

Definitions:

Sodium Ions

Positively charged particles of sodium, which play crucial roles in the body such as maintaining fluid balance, transmitting nerve impulses, and muscle contraction.

Substance P

A neuropeptide involved in the transmission of pain and other sensory information to the central nervous system.

Pheromones

Chemical substances produced and released into the environment by an animal, affecting the behavior or physiology of others of the same species.

Cytokines

Signaling proteins secreted by cells, playing a critical role in immune system responses and inflammation.

Q3: The ddNTP:dNTP ratio is too high (too

Q19: The financial balances for the Atwood Company

Q42: Parent Corporation loaned money to its subsidiary

Q51: Jager Inc. holds 30% of the outstanding

Q67: Which of the following results in a

Q73: Pell Company acquires 80% of Demers Company

Q97: A subsidiary issues new shares of common

Q112: Carlson, Inc. owns 80 percent of Madrid,

Q116: Carnes Co. decided to use the partial

Q122: Pepe, Incorporated acquired 60% of Devin Company