On January 1, 2011, Rand Corp. issued shares of its common stock to acquire all of the outstanding common stock of Spaulding Inc. Spaulding's book value was only $140,000 at the time, but Rand issued 12,000 shares having a par value of $1 per share and a fair value of $20 per share. Rand was willing to convey these shares because it felt that buildings (ten-year life) were undervalued on Spaulding's records by $60,000 while equipment (five-year life) was undervalued by $25,000. Any consideration transferred over fair value of identified net assets acquired is assigned to goodwill.

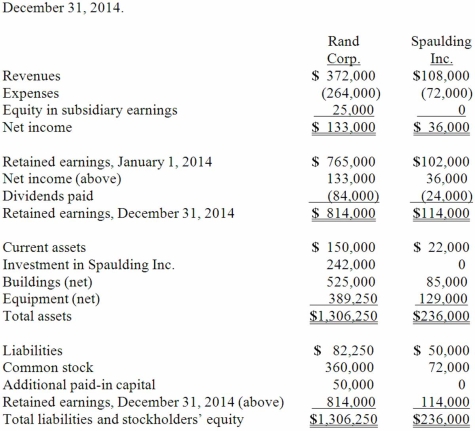

Following are the individual financial records for these two companies for the year ended December 31, 2014.

Required:

Prepare a consolidation worksheet for this business combination.

Definitions:

Incremental Change

Gradual modifications or improvements made over time to processes, products, or systems.

Wheel of Innovation

A conceptual model outlining the cyclical process of innovation, from idea generation through to implementation and market introduction.

Experimenting

The process of carrying out trials or tests to discover, prove, or evaluate the effectiveness or truth of something.

Feasibility

The measure of how possible or practical the implementation of a project, plan, or process is, usually considering economic, technical, and logistical factors.

Q14: The ability of a molecular-based assay to

Q20: The delivery of accurate voltage and current

Q22: A blood sample is received in the

Q41: Tinker Co. owns 25% of the common

Q43: Dodge, Incorporated acquires 15% of Gates Corporation

Q43: One company acquires another company in a

Q60: Webb Company owns 90% of Jones Company.

Q69: Regency Corp. recently acquired $500,000 of the

Q89: Salem Co. had the following account balances

Q91: The following information has been taken from